by Eric Price | Jan 16, 2024 | Featured News, Front Page, JetBlue, MNPL, Perusals, Recent News, Row 2, Spirit, Transportation Territory, Uncategorized

Federal Judge Slaps Down JetBlue-Spirit Merger, Citing Competition Concerns Federal Judge Slaps Down JetBlue-Spirit Merger, Citing Competition Concerns IAM141.org 16 January 2024 U.S. District Judge William Young blocked the $3.8 billion attempt by Jetblue to purchase...

by Eric Price | Sep 15, 2023 | Front Page, MNPL, Other News, Perusals, Recent News, Row 2

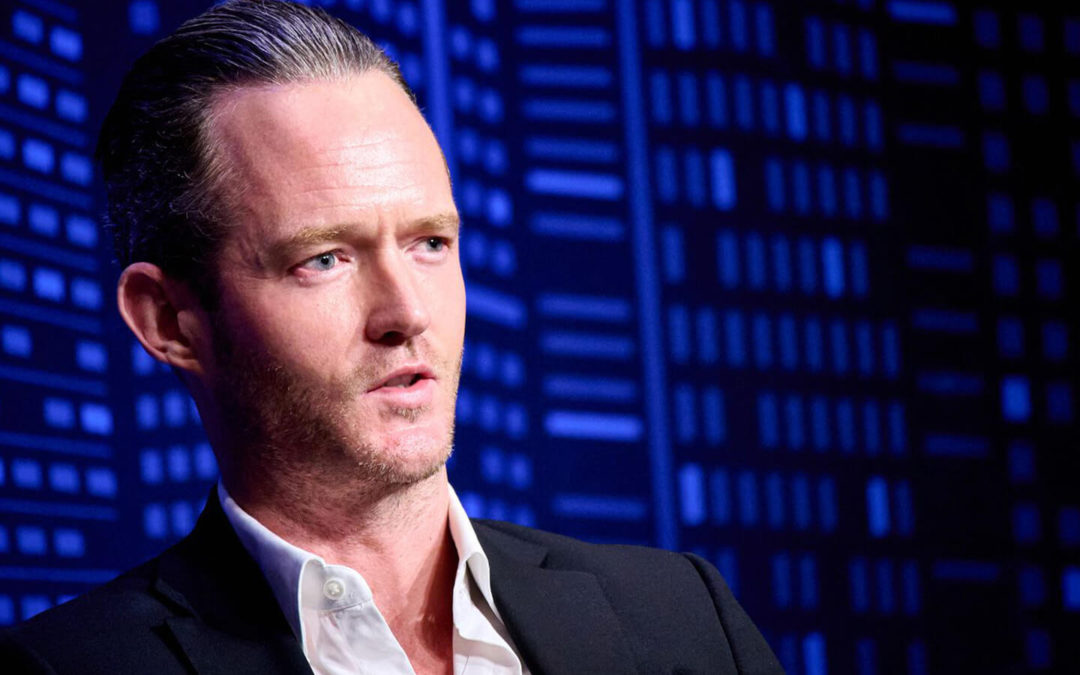

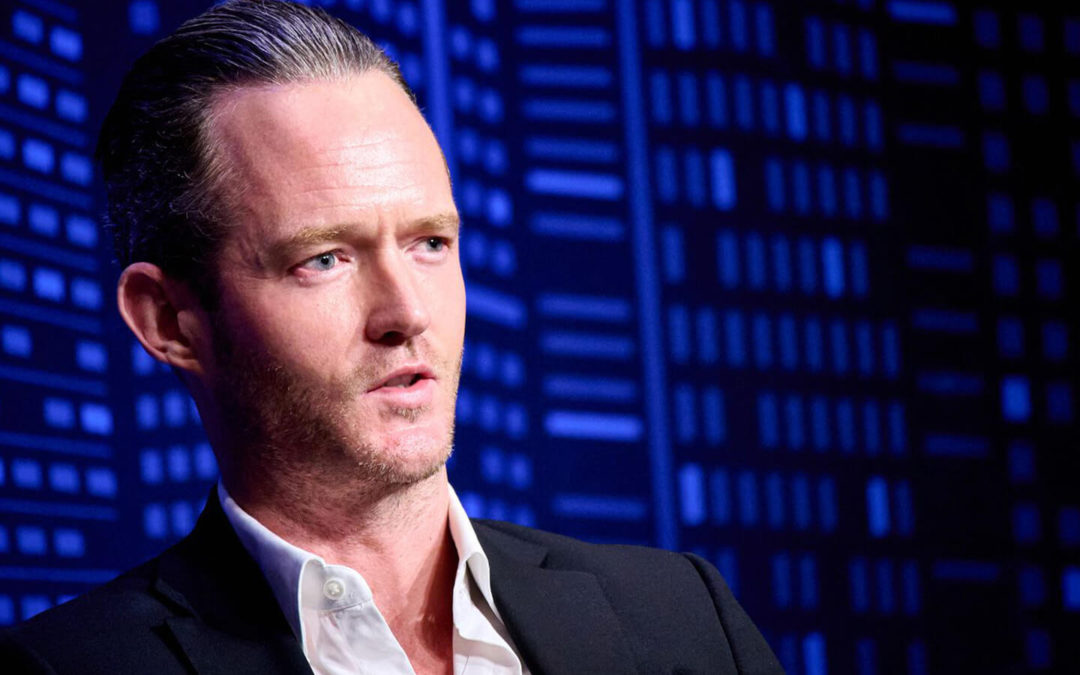

Millionaire Real Estate CEO thinks that workers need to be put in their place, using tactical unemployment. Millionaire CEO Calls Workers “Arrogant,” Calls for Higher Unemployment to Teach Them a Lesson IAM141.org September 15, 2023 Tim Gurner, the...

by Eric Price | Sep 13, 2023 | Front Page, MNPL, Other News, Perusals, Recent News, Row 2, Safety

Airline Worker Injuries on Rise IAM141.org September 13, 2023 As heatwaves plague the country, few places are hotter than Phoenix. Workers and city officials gathered at Phoenix Sky Harbor on Wednesday to share heat-related health and safety concerns. Sky Harbor...

by Eric Price | Aug 29, 2023 | Front Page, MNPL, Other News, Perusals, Recent News, Row 2

U.S. Department of Transportation Slams American Airlines With Record Fines for Tarmac Delays IAM141.org August 29, 2023 WASHINGTON – Today, the U.S. Department of Transportation charged American Airlines a $4.1 million fine for breaking the law by repeatedly...

by Eric Price | Aug 27, 2023 | Front Page, MNPL, Other News, Recent News, Row 2

American Dream Fading as 75% of U.S. Homes Out of Reach for Middle Class IAM141.org August 27, 2023 The Unaffordable Neighborhood: 75% of Homes Out of Reach for Middle-Income Buyers A recent report from the National Association of Realtors and Realtor.com paints a...

by Eric Price | Aug 8, 2023 | Front Page, MNPL, Other News, Perusals, Recent News, Row 2

Summer Storms and Short-Staffing Cause Massive Travel Disruptions IAM141.org August 8, 2023 On Monday, storms impacting the East Coast, stretching from Tennessee to New York, led to nearly 9,000 flights being delayed and an additional 1,768 cancellations across the...